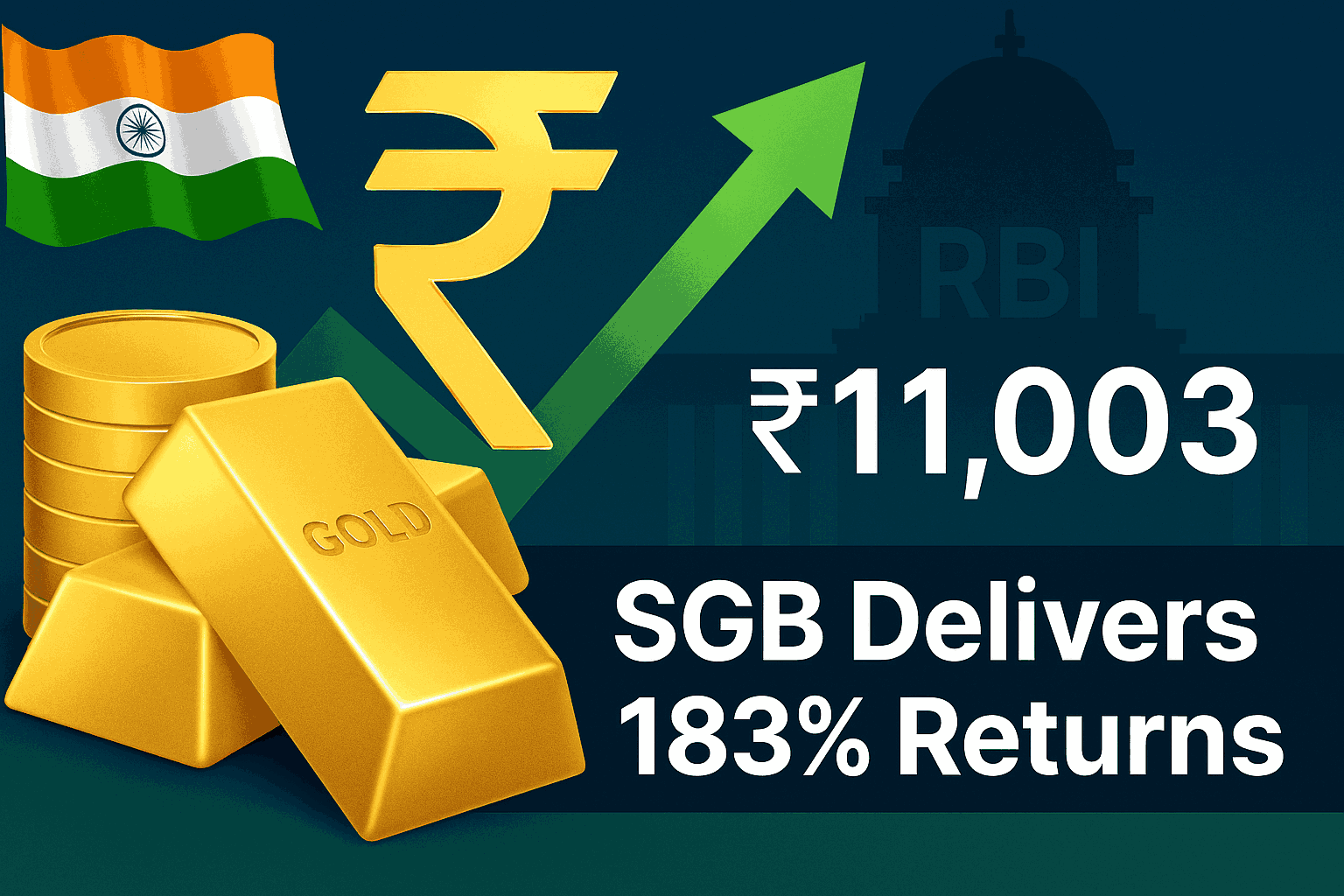

The numbers I’m seeing tell a story that’s making investors across the country do a double-take. The RBI fixed the premature redemption price at ₹11,003 per gram for Sovereign Gold Bond 2019-20 Series 4, and when you compare this to what investors originally paid, the returns are absolutely staggering.

The Math That’s Getting Everyone’s Attention

Here’s what’s wild about this announcement – if someone had bought one unit of SGB in 2019 for Rs 3,890, then on premature redemption in 2025, he will get Rs 11,003. That’s a massive jump that caught my attention immediately.

When I calculated the actual returns, the numbers were even more impressive than expected. The bond was originally issued at ₹3,890 per gram, and now investors can redeem it at ₹11,003 per gram. This translates to roughly 183% returns over just five years – something that makes traditional investments look pretty modest in comparison.

How RBI Calculated This Price

The calculation method behind this price is straightforward but effective. The RBI calculates this rate using the average closing gold prices from the last three trading days – September 12, 15, and 16, 2025.

What I’ve found through my research is that this three-day average system protects investors from any single-day price volatility while ensuring fair market pricing. The India Bullion and Jewellers Association provides reliable gold price data, making this calculation transparent and trustworthy.

The Five-Year Rule Finally Pays Off

The timing here is crucial. When I analyzed the structure of Sovereign Gold Bonds, I discovered they come with an eight-year maturity period, but there’s a special exit window after five years. The SGB 2019-20 Series 4 was originally offered for subscription on September 9, 2019, with the subscription period ending on September 13, and the actual bond issuance happening on September 17, 2019.

Now that five full years have passed since the issuance date, investors get their first opportunity to exit before the full eight-year term expires. This premature redemption option becomes available exactly five years after the bond issue date, which is why September 17, 2025, marks this significant milestone for Series 4 investors.

Beyond Price Gains: The 2.5% Annual Interest

What makes this even more attractive is the additional benefit that many people overlook. Sovereign Gold Bonds pay 2.5% annual interest on the invested amount, credited to investors’ bank accounts every six months. This interest component runs separately from the price appreciation we’re seeing.

The final interest payment gets added to the principal amount at maturity, which means investors have been receiving steady income throughout their holding period while also benefiting from gold’s price appreciation. This dual benefit structure explains why SGBs have gained popularity among investors looking for gold exposure without physical storage concerns.

Government Backing Makes the Difference

What sets these bonds apart from other gold investments is the government guarantee behind them. SGBs function as government-backed securities with their value tied directly to gold prices per gram. While investors purchase these bonds using cash payments, the redemption at maturity is also processed in cash rather than physical gold. The Reserve Bank of India issues these bonds as an official representative of the Government of India.

This government backing eliminates the typical concerns around physical gold storage, purity verification, and security issues. When I compare this to buying physical gold, the SGB structure removes all the hassles while providing the same price exposure plus that additional 2.5% interest component.

Current Market Context

The gold market has shown remarkable strength over the past few years, with prices reaching new highs consistently. Global economic uncertainties, inflation concerns, and geopolitical tensions have all contributed to gold’s strong performance. SGBs have captured this entire price movement while providing the safety of government backing.

Recent market data shows gold continuing its upward trajectory, which suggests that investors who choose to hold until maturity might see even higher returns. However, the current redemption option provides a guaranteed exit at today’s attractive prices.

What This Means for Current SGB Investors

For investors holding SGB 2019-20 Series 4, September 17, 2025, represents a critical decision point. They can choose to redeem their bonds at ₹11,003 per gram and lock in their 183% gains, or continue holding for the remaining three years until full maturity.

The decision depends on individual financial goals and market outlook. Those needing liquidity or wanting to book profits have a clear exit opportunity. Others might prefer waiting to see if gold prices climb even higher by the 2027 maturity date.

Looking at the Bigger Picture

This announcement highlights the success of the Sovereign Gold Bond scheme since its launch in 2015. The scheme was designed to reduce physical gold demand while providing investors with gold price exposure, and results like these demonstrate how effectively it has worked.

The combination of capital appreciation, regular interest payments, and government backing has created a compelling investment proposition. These returns validate the decision of investors who chose SGBs over physical gold or other traditional investment options during 2019.

What makes this particularly noteworthy is how SGBs have delivered superior returns compared to many equity investments during the same period, while offering the stability and security that gold traditionally provides during uncertain economic times.